FAIRFAX, Va. (WAVY) – The family of a retired submarine commander is taking their lawsuit against Wells Fargo Bank and Navy Federal Credit Union to a higher court, claiming they should have realized he had diminished mental capacity when he made more than 70 international wire transfers totaling more than $3.6 million.

In summer 2019, Larry Cook had a stroke, and a year later he got an email, a phishing email disguised as something from Amazon, tricking Cook into thinking he had ordered an iPad and a Playstation.

“Because of the diminished capacity of the stroke, the frontal lobe stroke, he was unaware of the fraud that was happening to him and he bought it hook, line and sinker,” said Janine Satterfield, Cook’s surviving niece and the administrator of his estate. Cook died in 2021, about six months after the scam had begun.

Satterfield is a financial professional, and said that to an observant person with sound mind, the email had some telltale signs that it wasn’t real.

“The email address of where it’s coming from is spoofed, it’s fake, that’s the first thing that you have to look at,” as she points to the “info@amaznusshipping5hub.com” on the “From” line.

Cook was the perfect mark – he had millions in savings but lived alone and now had severely compromised judgment. He began a series of 74 transfers to someone in Bangkok, Thailand, and they totaled more than $3.6 million.

Satterfield found out that the threshold for reporting an international wire transfer in Thailand is $50,000 – and all of the transfers came in just below that, usually about $49,500.

Kimberley Murphy is the family’s attorney, and they are suing two banks, Wells Fargo and Navy Federal Credit Union, where the wire transfers originated. According to the lawsuit, NFCU uses Wells Fargo for international wire transfers.

“They should have stopped him,” Murphy said.

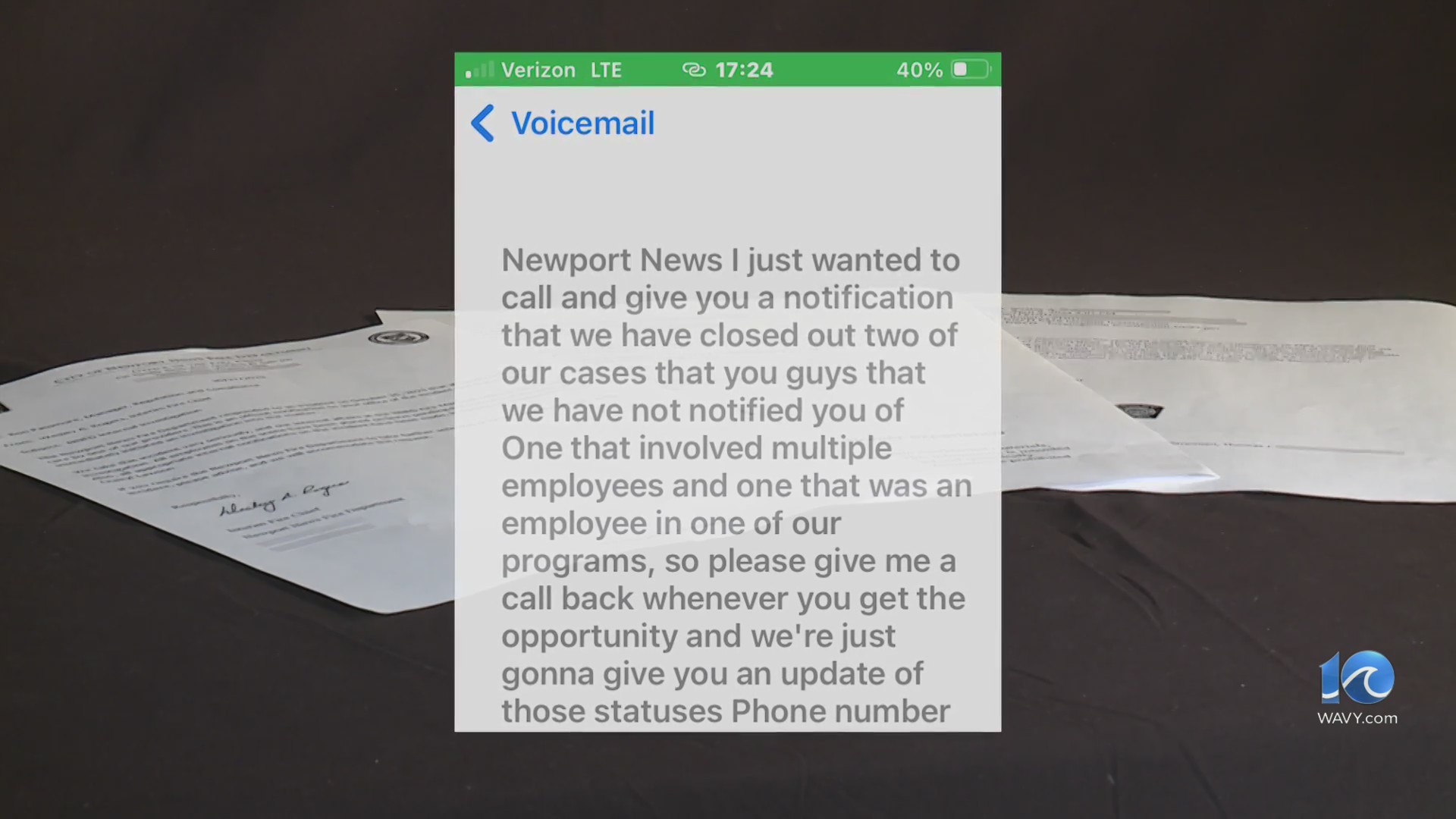

The lawsuit says Navy Federal did alert Adult Protective Services after nearly 30 transfers had already happened, but more than 40 additional wires were authorized.

Murphy said a bank can’t simply follow a client’s instructions if there’s evidence that fraud is occurring.

“There are statutes on the books that allow for even a period of 30 days to stop the transactions,” she said.

Satterfield said it’s a cautionary tale that anyone can get duped out of their money.

“We’d never have suspected that he would have fallen prey to such a scam,” she said about her uncle, a college graduate, decorated naval officer and defense consultant after retirement.

The family’s lawsuit was dismissed in federal district court, but they plan to appeal to Fourth Circuit Court of Appeals.

A Wells Fargo spokesman responded in this statement to WAVY: ““Wells Fargo takes financial exploitation very seriously. We are committed to helping our customers avoid fraud and scams through various resources, including ongoing education efforts.”

A spokesman for Navy Federal Credit Union said “We respect the decision of the court” regarding the dismissal of the lawsuit by the lower federal court.