FORT WAYNE, Ind. (WANE) — Tax season is starting late this year, and there are a number of changes to the tax laws in addition to stimulus checks and the continuous spread of COVID-19.

“A lot of people won’t be happy,” said Keith Layman, managing partner for Apple Tree Financial Group. “I know a lot of clients use it [refunds] to save up, so then it’s their savings, their vacation money, their house remodel money, whatever it may be. So there are going to be some unhappy people come filing time.”

This year, one of the biggest changes is how taxes will be prepared. Instead of making an appointment with a CPA or tax professional in person, several places are asking clients to email in their materials, leave them in the mailbox and then do a video conference.

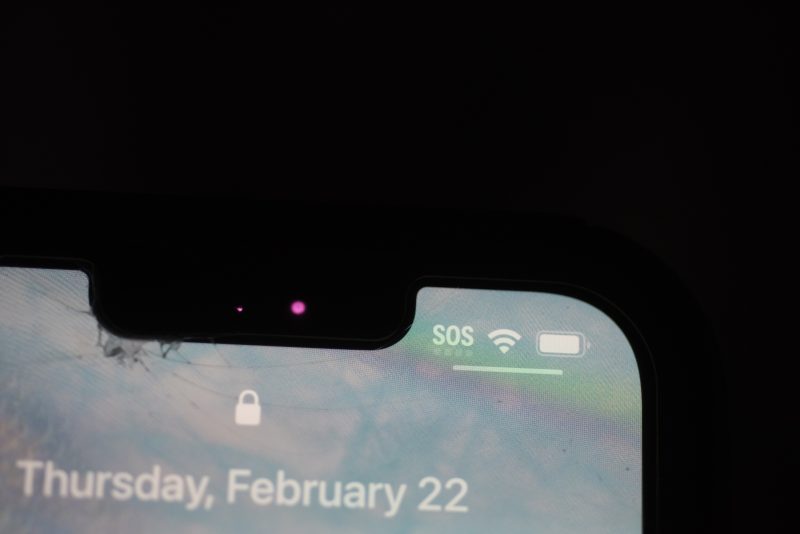

Luckily, you can prepare your taxes early even though the IRS won’t begin accepting returns until Feb. 12. The pushed start date is due to the IRS’s need to do programming and testing of IRS systems following the tax law changes. The last day to file has yet to be pushed back from April 15. However, that could change due to the pandemic.

Layman said the best way to file taxes is electronically, which is how the IRS is asking for taxes.

“They don’t really want paper anymore or paper returns,” Layman said. “The second is that it’s easy to track so it’s less likely to have it lost in the mail. It’s not that you can’t get a refund, it’s just a lot easier and quicker to the taxes.”

Many who haven’t received their stimulus check may have sent their tax returns in the mail. So far, a majority of Americans have received two stimulus checks.

When the first round of stimulus checks went out, recipients were supposed to have received letters from the government about how much they were given. Tax preparers will need to know how much was received because if you didn’t get enough, you will get the difference back as a refund.

“If you made a little less income in 2020, you may qualify for more. Or you had a child in 2020, so you qualify for more. So those are things that will be different,” Layman said.

But will we have to pay the money back?

When stimulus checks first went out, officials said people would not have to pay it back. The IRS is still saying that, but Layman said it’s possible that will change.

“That was one of our questions as preparers. What if I normally owe 2,000 bucks? Do I now owe $3,200? And [the IRS] is claiming no, but again, we will see once we start filing,” Layman said. “Having done this for several years, I know that what they say versus what the IRS operates, it can be very different.”

Layman said people who possibly will have to pay back the stimulus checks will be widows or widowers as of now.

If your spouse passed away in early 2020 before COVID, and then you got a stimulus check that was for you and your deceased spouse, the IRS is saying you have to pay back the portion that went to your spouse because they weren’t with you when COVID hit.

In addition, newly elected President Joe Biden has a proposal for first-time homebuyers, giving them up to $15,000 to apply toward a down payment. The tax credit is modeled on a homebuyer tax break that was put in place by then-President George W. Bush in 2008 during the Great Recession. However, Bush’s was an $8,000 loan you pay back on your tax return over 10 years.

Biden’s tax credit is a cash refund that a buyer can get immediately. If you wanted to buy a home in February, you can get the money and use it for a downpayment instead of waiting to receive the tax credit in 2022.

“Getting it upfront is better if you truly plan on putting it down on the home,” Layman said. “You could have $15,000 to put down, which could help you with the [private mortgage insurance]. It definitely would be in my thought process better to get it upfront to have more equity in your brand new home.”

Biden has also proposed several tax credits he says will help boost the economy. One of those plans is a 401K that instead of giving you a deductible, the government would give everyone a tax credit.

For example, let’s say you put $1,000 in your 401K. Instead of hitting a deductible, you would get a tax credit. Layman said the details are still in the works.

Another plan is to eliminate the step-up in cost basis. This means a beneficiary who inherits assets that have grown significantly during the decedent’s lifetime will likely be required to pay much higher taxes when the asset is later sold.

“This is one of the biggest negatives for all taxpayers,” Layman said. “But some of the others are good. The homebuyer credit, I mean, wow! And right now, if it doesn’t change how they define a homebuyer — is not just this is the first home you’ve ever brought. If you haven’t purchased a home in the last five years, you are a first-time homebuyer.”

Layman’s advice to those filing taxes is to be patient, get them done early and have a tax professional do them.

“You may have to be patient,” Layman said. “COVID has really thrown the IRS for kind of a loop last year. The IRS shut down like everybody else. So there are people who were upset because their stimulus checks came seven months later, and there are still people who still haven’t gotten their first round of stimulus checks.”

He added, “That’s all done by the Treasury, which is the IRS. So if we get another stimulus check in February or March, that’s beginning to overwhelm the IRS, who’s also doing tax returns.”