NEWPORT NEWS, Va. (WAVY) — 5% raises for all eligible employees and increased starting pay for public safety positions are key parts of Newport News’ proposed fiscal year 2024 budget.

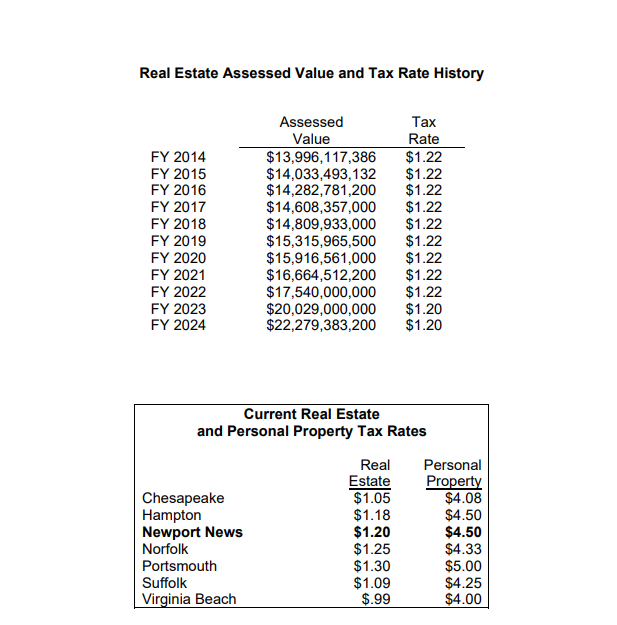

To pay for it, city residents could see their taxes go up, as the budget currently calls for no changes in the city’s $1.20 real estate tax rate despite an increase in real estate assessments of about 9.5%. Hampton is considering a roughly 2 cent decrease in their tax rate to $1.16 after assessments increased there by about 10%.

Mayor Phillip Jones though thinks that $1.20 rate is too high. He says two options have been presented, one that lowers than tax rate from $1.20 to $1.18, and another than lowers the personal property tax to 80% or 90%. The city is also looking at changes to the amusement tax.

The overall savings to taxpayers would be about $4 million, Jones said Thursday.

Newport News City Manager Cynthia Rohlf cited inflationary impacts and future economic uncertainty impacted budgetary choices, including potentially lower growth in real estate tax revenue in future years. The city expects a $27.1 million increase in real estate taxes compared to last year, from $224.1 million to $268.1 million, an 11.2% change.

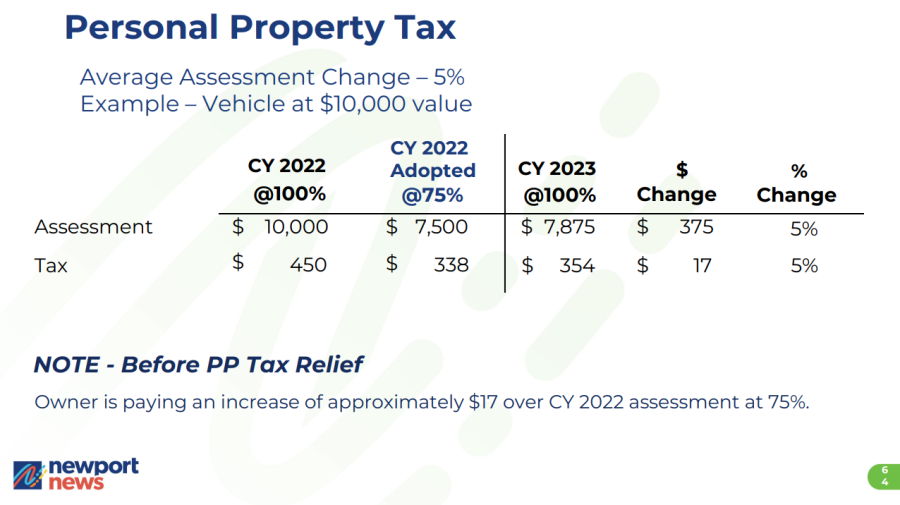

The budget at the moment shows personal property ($4.50 per $100 assessed value) is expected to go up about 5% on average, the city says, with an estimated increase of about $3.2 million from last year.

They gave an example that shows an owner of a vehicle that was valued at $10,000 in 2022 will pay about $17 on average compared to the 75% discounted rate in 2022, before any personal property tax relief.

In the meantime, city council will continue discuss and tweak Rohlf’s proposed $1.1 billion FY24 operating budget ($610.3 million general fund), which also includes $7.5 million in increased retirement contributions, $4.2 million in debt service reserve and $3.4 in increased funding to the school division.

Here’s a closer look at some of the proposed budget items:

5% general wage increase for eligible employees, maintaining $15 per hour minimum wage: The city’s budgeted $8.1 million for raises for all eligible employees starting July 1, 2023. They also plan to keep the city’s minimum wage at $15 per hour for all positions (this was implemented in the FY23 budget).

$3.4 million increase in city support to the local school district, up to $119.5 million overall. Read the district’s proposed operating budget here.

$3.1 million for incentives and stipends for public safety (police, fire, sheriff and juvenile services) recruitment and retention, with $2.5 million also set aside to adjust salaries to the market rate with job listings.

Recruit pay is increasing for the fire department ($45,213 at hire to $48,800) and police department ($48,800 to $50,000).

The sheriff’s office will receive $200,000 to fully fund their body-worn camera

and Taser contract.

You can read the full proposed FY24 budget here. There’s also a slideshow of the some of the highlights here.

Public hearings on the budget will be held April 11 during regular council session and on April 13 at the Denbigh Community Center.