PORTSMOUTH, Va. (WAVY) — As drivers turn to fuel-efficient and electric vehicles, they buy less gas at the pumps.

If your vehicle is registered in Virginia and is considered fuel-efficient, you will likely be charged an additional highway use fee (HUF) when you go to renew your registration. It was something established by the General Assembly four years ago, and it has left a Norfolk resident in a “huff.”

A huff, a “fit or petty annoyance” — that’s how Scott Wertz feels about the highway use fee, that he’s being charged for efficiency, and he’s being penalized for a fuel-efficient car.

Virginia’s roads are maintained, in part, through the taxes drivers pay at the pump. This fee helps make up the shortfall that results from more drivers switching to fuel-efficient and electric vehicles.

“That is what they are doing with this highway use fee,” he said, “penalizing folks like me who are driving fuel-efficient vehicles.”

Wertz discovered this fee charge on his vehicle registration, a highway use fee of $37.56 for his fuel-efficient 34 miles to the gallon 2017 Toyota Corolla.

“We should be more fuel-efficient, and we should be using fewer fossil fuels,” he said. “Like I said, lowering our carbon footprint, so why am I penalized for it?”

Wertz sent an email to local Del. Jackie Glass (D-Norfolk) complaining about the highway use fee.

He got this response.

“The state will continue having to make up the revenue lost to the fuel-efficient vehicles in one way or another.”

Excerpt from Del. Jackie Glass email

Wertz added that “one way, or another, my point is, let’s think a different way now.”

This fee was established by the Virginia General Assembly in 2020 to make up for less gas tax money collected at gas pumps, with the explanation that fuel-efficient vehicles get more miles to the gallon and don’t fill up as often.

“Recent advancements in fuel economy as well as the adoption of hybrid and electric vehicles has eroded the purchasing power of the gas tax,” Scott Cummings, DMV’s assistant commissioner for finance, told 10 On Your Side.

Cummings pointed out that the gas tax in Virginia that goes toward state coffers is 29.8 cents per gallon, but drivers aren’t gassing up as much. They don’t need to, and that’s why Cummings said we need the highway use fee.

“The highway use fee has recovered $60 million in unpaid gas tax revenue that otherwise would not have been collected to offset the wear and tear vehicles are imposing on our highway system,” Cummings said.

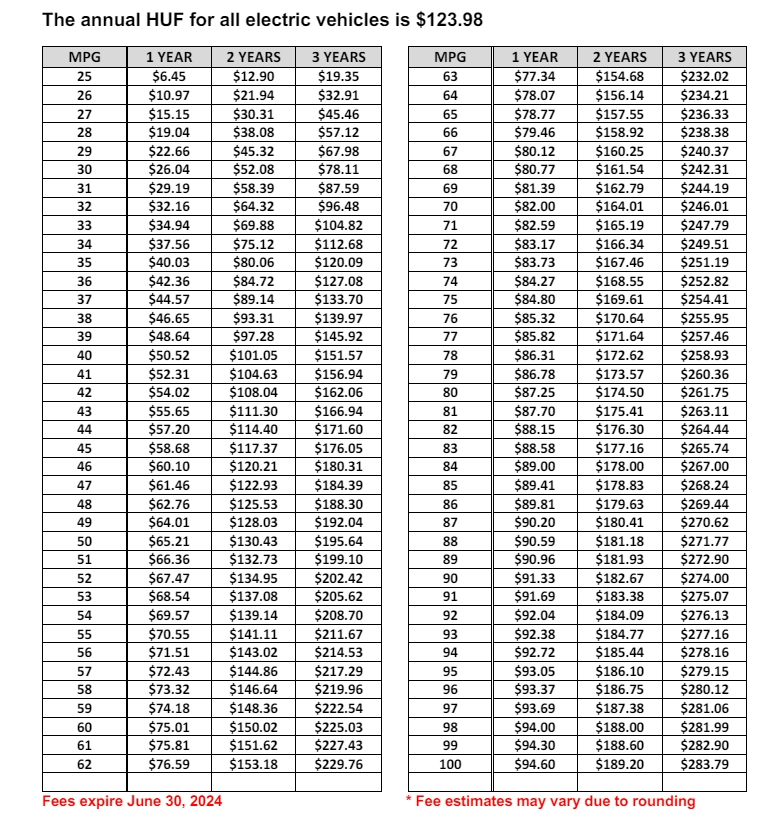

That number is now $65 million from all the highway use fees at different miles per gallon, as seen on the 2023 estimated highway use fee chart.

The highest charge on the chart is $94.60, for vehicles that average 100 miles per gallon.

When your miles-per-gallon is less than 25 miles per gallon, according to the manufacturer’s combined fuel economy, you don’t pay anything because in theory you’re going to the gas pump more with a less fuel-efficient car.

“The highway use fees are aimed at recovering that amount that is not being captured by the gas tax,” Cummings said.

If you have an electric vehicle, you never go to the pump, and the annual fee for those drivers is $123.98 per year.

Wertz understands that, but said those buying the gas should be the ones paying.

He thinks raising the gas tax is the answer.

What about that DMV?

“Increasing the gas tax is not a sustainable option when fuel economies are advancing like they have been,” Cummings said. “Electric vehicles will never pay any gas tax.”

DMV Mileage Choice Program

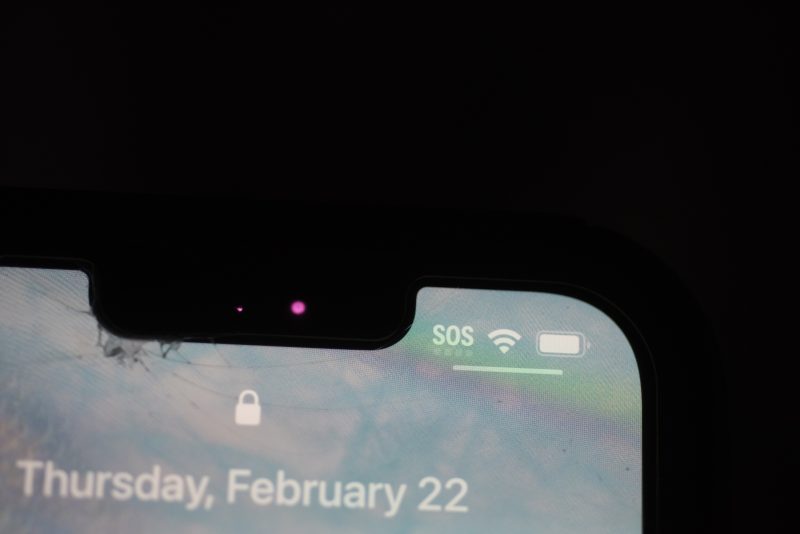

“All 1996 and newer passenger vehicles have the port you’re looking for,” an instructional video provided by the DMV states.

To answer critics like Wertz, the General Assembly also established the Mileage Choice Program to save money for those who drive less than 11,600 miles per year, the estimated number of miles the average driver travels in a year.

It’s an alternative to the highway use fee, which is paid in full when you get your vehicle registration.

With the Mileage Choice Program, you only pay for the miles you drive.

“The port itself has a unique shape,” according to the video.

This video shows how DMV knows how many miles you drive. That plug records the miles driven.

Wertz is skeptical of that, as he is unsure what other information is being recorded.

“They can track your mileage,” he said, “and for me, I think there is a privacy concern because you don’t know what else they are tracking.

10 On Your Side asked Cummings about that.

“The DMV does not receive any specific customer information,” Cummings said. “We only receive the aggregate number of miles the vehicle drove so we can confirm the payment amount.”

You pay the HUF if you register a:

- Fuel-efficient vehicle, which is any vehicle that has a combined fuel economy of 25 miles-per-gallon (mpg) or greater

- Vehicle made in a year in which the average combined mpg rating for all vehicles produced in that year is 25 mpg or greater

- Low Speed Vehicles pay an annual $25 HUF

There is an equation to determine how much you will be charged, but you don’t need to do the math. The DMV has an HUF chart with the current fees listed.

You can pay the HUF when you renew your vehicle registration, or you can pay over time with the DMV’s mileage choice program. If you decide to enroll in the program, you must sign up before renewing your vehicle registration.

Click here to see if you are eligible for the mileage choice program and to learn more about how it works.